If you are here asking complicated questions about Credit Limit increase, then you are here at the right place. Is your existing credit limit insufficient for your needs? If you wish to boost your Chase credit limit, you should know that it is simple to do so. If you have an above-average credit score, you can easily request any credit increase you want. If you want to check your credit score you visit Chase credit journey official website. There will, of course, be additional conditions in addition to the credit score. So, without further ado, here’s how to boost your Chase credit limit.

3 questions to ask yourself

Before you proceed to request a credit limit increase, ask yourself the following question first.

1. Why do I want to increase my Chase credit limit?

Perhaps you are planning to make a huge purchase that you want to be charged to your card. If so, then let Chase know about this when you request an increase to your credit limit.

Perhaps you are planning to max out your credit limit to purchase something that you can’t afford without credit. If this is the case, then don’t expect that your limit would be approved. You may want to rethink your purpose for requesting an increase to your credit limit.

2. What is my credit limit at present?

You should be aware of what your credit limit is before you even request for an increase. Check Chase.com to know your credit limit. Just log on to your account and select the card you want to check. You should find your credit card information on the page that comes up next. Check your current balance and available credit. These two figures added, gives your credit limit.

The credit balance is the total amount you used as per your last statement. Available credit is the amount left that you can use. Understanding these two allows you to regulate or plan your credit card use.

3. What are the best practices to get an increase in the credit limit?

Creditworthy customers have better chances of getting a credit limit increase. The bank will look at three things:

- whether you have been a customer for at least six months.

- whether you pay your bill in full and on time each month.

- whether you are reasonably using your present credit limit or if you are maxing out your credit.

New customers and those who pay late or in parts have a very slim chance of getting a credit limit increase.

Read about other cards or check your card balance MyGiftCardSite: The Best Gift for Your Loved One CabelasClubVisa: All The Things Your Card Can Do

How to Increase Chase Credit Limit

A positive credit score will easily get you an increase. And there are a couple of ways to do that. In order to request an increase here are the three methods:

- Call Chase customer service hotline.

- Request through Chase official website.

- Get a new card with a higher credit limit.

Call the Hotline

For those of you who prefer using the Chase hotline, you should call 888-245-0625. Try to be friendly as much as you can and try not to sound so desperate when you are requesting an increase. It would make the process a lot easier and faster if you make it sound like a casual conversation. Don’t tell them why you need the increase. Tell them why you deserve it. Also, be reasonable with your credit limit increase. Don’t ask for 10 times your current limit. That would be absurd! Ideally, the reasonable amount would be between 10% and 25% of your current limit.

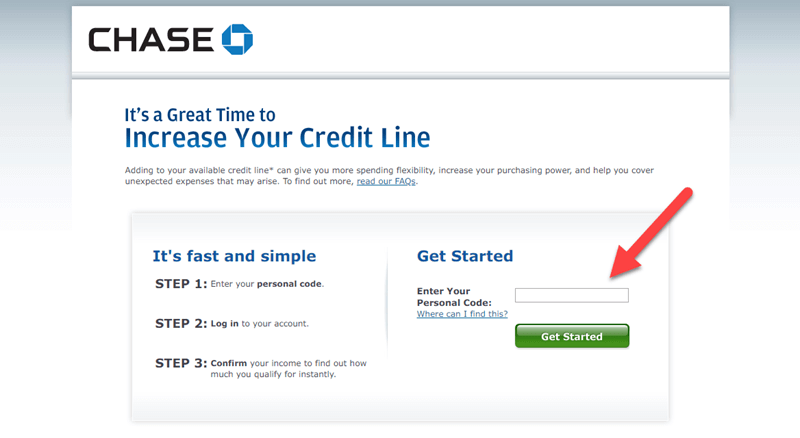

Request through Chase official website

If you would prefer requesting via Chase’s online page, you may do so as well. But before you do, please do not access your Chase account if you are connected to a public Wi-Fi network. Your account could be at risk in such a situation. Always access your Chase account from a private or secured network. Preferably, on your home internet connection or your phone’s own data network.

Credit Limit Increase Requirement Importance

As long as you meet that requirement, you may now open your browser and type in the address bar https://chase.com/increasemyline and press Enter. Type in your Chase personal code and then log in using your Chase approved information such as email and password.

You will be directed to another page that will require you to fill up regarding your income and credit score. Afterward, you will find out how much increase you will be qualified in a matter of minutes. That’s how easy it is. Related Topic: 2 Ways To Check Your Chase Credit Card Application Status

Get a new card

The simplest way is to just get a new card for Chase credit limit increase. You can add your current credit limit to the new one or you can simply ask that you transfer your old account to the new one.

A balance transfer is an excellent approach to persuade Chase to give you an increase because it means they can charge you for a transfer fee and they earn interest if you fail to pay your dues.

All of this privilege is only possible if you have a good credit score history. Or at least an above-average credit score will do.

Wait for your limit to increase naturally

Most banks, including Chase, automatically increase a customer’s credit limit if the customer is responsible enough in paying his or her balance. The automatic change often takes place every 6 to 12 months. Hence, if you always pay in full and in time, you only need to be patient and your credit limit is sure to increase in a few months.

However, if despite paying in full and on time your limit does not increase, then it is time to file a request.

What if your request is denied?

Just because you made a request, doesn’t mean you will be granted a credit limit increase. As said earlier, Chase has criteria for granting an increase. What do you do if your request is denied?

You can start off by calling Chase and asking again. Explain why you think you deserve a higher credit limit. As mentioned above, it could be for a large purchase, an increase in your income, or because you are a good payer. If you are able to make your case convincing, then chances are your request would be approved.

If you are still denied after talking to Chase, then perhaps you should look into your credit score and how you use your credit. Your behavior in using your credit matters considerably when a bank decides whether to do a credit limit increase or not.

Do you want to check your balance? Read these articles to guide you. MyBalanceNow: Check Your Balance Anytime, Anywhere

What is a credit score?

A credit score is a statistical figure that tells whether a consumer is creditworthy or not. It is computed based on a person’s credit history. Lenders and banks use this to decide if a customer has the capacity to pay. the score could be from 300 to 850. a higher score means the customer is trustworthy.

Why know your credit score

Knowing your credit score allows you to understand how you have been using your credit and whether you are eligible for an increase in credit limit. It would be ideal to monitor your credit limit not only because you want an increase, but more so you can regulate your use.

Check your score periodically to see if it is correct and updated. Several sites allow you to can check your credit score. The following are just a few.

- Equifax

- Experian

- Transunion

However, these three sites would charge you for checking your credit report. Do not fret, though. There are sites where you can check your credit score for free. Each year, US consumers receive one free credit report from these three main bureaus. Check out annualcreditreport.com for a free report.

You may also visit the following sites for a free credit report and score:

- Chase CreditJourney

- Credit Karma

- Credit Sesame

- Quizzle

Raise Credit Score

If you want to request an increase in your credit limit, then raising your credit score is your best bet. Add to that, you also get to improve your credit habits.

It is easy to increase your score; you only need discipline. Do the following and you’ll be on the right track.

- Pay all your bills, utilities and rents, for example, monthly.

- Make sure you pay in full

- Be sure to pay any outstanding credit card debt you have incurred

- Avoid closing your oldest accounts

- Do not open too many new credit cards

Chase Credit Journey

You can also check your credit score in your Chase account. You only need to log in to your account and go to CreditJourney. You will find your credit score at the bottom right-hand of the homepage.

Apart from your credit score, your late payments and number of accounts opened are also viewable in CreditJourney.

Note that CreditJourney is a free service from Chase.

You can scroll to the bottom to check the score simulator, which will show you what affects your credit score and how. Try adjusting the parameters so you could see how your score would behave depending on each action. Some parameters that you will find would be the following:

- Adding a balance transfer

- Adding a credit card

- Adding a loan

- Adding a public record: foreclosure, child support, or wage garnishment

- Adding credit inquiries

- Allowing one or more accounts to be delinquent

- Canceling your oldest credit card

- Eliminating all card balances

- Having an account go to collections

- Maintaining on-time payments to all accounts

- Raising or lowering the balances on your cards

- Raising the credit limit on a card

After adjusting the parameters, click on the Simulate button (it is green) to see what your score would be with the parameters you set. This is a good way to understand how you should be using your credit.

Looking for hotline numbers, check out these articles

Boost Mobile Customer Service Number

Navy Federal Credit Union

AT&T

Fingerhut Customer Service

Chase Customer Service Phone Number, Email (Hours to Call)

FAQ

A positive credit score will easily get you an increase in your Chase credit limit. There are a couple of ways to do that. To request an increase, choose any of the following three methods:

1. Call Chase customer service hotline.

2. Request through Chase official website.

3. Get a new card with a higher credit limit.

1. You may request by calling Chase’s hotline: 888-245-0625

2. Go to Chase’s website to make a request. Type in your Chase personal code and then log in using your Chase approved information such as email and password. You will be directed to another page that will require you to fill up regarding your income and credit score. Afterward, you will find out how much increase you will be qualified in a matter of minutes. That’s how easy it is. Just make sure that you are in a private connection.

3. Get a new card to increase Chase credit limit. You can add your current credit limit to the new one or you can simply ask that you transfer your old account to the new one.

Requesting an increase in the credit limit is easy. Just pick up a phone and call customer service or go to the website through whatever console you have and request from there. You can also just get a new card with the credit limit you desire.

Chase Credit Limit Increase: Final Thoughts

Chase provides you with free access to your credit score as well as a 12-month history of your credit score. As a result, you can track your score over time, which is really useful if you’re trying to improve it. If you are approved for a higher credit limit with Chase, you will not be charged an additional fee. Everything will run well because the process is free. All you have to do now is ensure that you are qualified for the raise. An additional budget line item can be really beneficial. Having a higher credit limit does not guarantee that you would use it irresponsibly. Make wise financial decisions. In the end, if you don’t know how to properly separate your wants from your needs, you’ll lose your entire life savings. As a result, be economically responsible.

In your opinion, which is the best high-limit card available that offers and suits you the most? Tell us about your experience in the comment section so that other people would have an idea as well. That is if they are interested in the upgrade that Chase is offering to them.

If you have other concerns or topics that you want us to cover, feel free to leave your ideas and thoughts in the comment section as well. We will try hard to answer your queries as much as we can. Post questions about security policies, Consumer Credit Card, Balance Transfer Credit, credit card accounts, credit line increase, Billing statement, transfer credit cards, alerts for credit, credit resources, credit activity, credit limit approval, current credit status, credit allowances, monthly credit, Income increase, Income verification or anything from the article!

I do not need my credit limit increased because I have another card so will leave it where it is . Thank you.

Your letter makes changing the credit limit so simple — log in, enter peronal code and update annual income.

I just spent 1/2 hour+ looking at various sights and I still have not found the right place.

FORGET IT!

I definitely do not agree with this, they are only telling that it will us get an increase to our credit limit but it doesn’t really happen! Though kudos as this was a good marketing strategy!