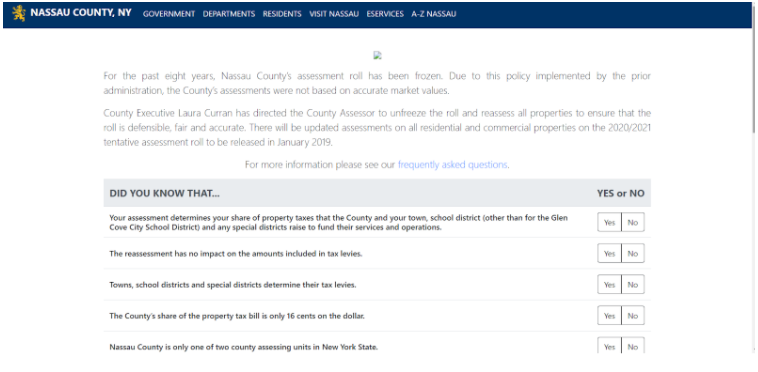

Nassaucountyny.gov/mynassauproperty is a website that assists property owners in determining the value of their homes. Aside from that, the official site of MyNassauProperty can be used to obtain tax map verification. The Nassau County Department of Assessment’s property assessment establishes land and enhancement values as the basis for property levies!

The patterns were applied to the 2020-2021 assessed values joining any assessment review commission offers made as of December 15, 2019. The property value that appeared in your notice of tentative assessed value is just one of a few factors in deciding your property charges for the 2021-2022 duty year.

The county’s appraisal roll incorporates more than 423,000 properties with an estimation of $264 billion. Approving structure licenses by affirming all new development and remembering the new incentive for the following evaluation roll. Properties rejected from the moving were properties that had new development or significant changes, properties that had an expense parcel merger or allotments, and properties with values surpassing $2.3 million in market value.

Note – if your property assessment increases, it doesn’t really mean your duties increment.

How does it work?

- Preparing applications for property charge exception and the basic and enhanced star programs for qualifying Nassau County mortgage holders.

- Helping general society through the department’s effort program.

- In your correspondence with the department of assessment, it would be ideal if you incorporate the location of the property you wish to have reviewed and your contact data.

You will see the impacts of the TPP in your school charge bill in October 2020 and your general tax bill in January 2021

Read more articles from these links icanhascheezburger, northshoreconnect, myprogramminglab, mynassauproperty, meetscoresonline

About The Department Of Assessment

The department of assessment is liable for growing reasonable and even-handed evaluations for all private and business properties in Nassau County on a yearly premise. In spite of the fact that tpp has been approved by the state, it must be passed by the Nassau County Legislature to be executed.

Consideration homeowners: Notice of tentative assessed value for 2021/2022 now available notice of tentative assessed value is a yearly proclamation from the Nassau County Department of Assessment (DOA). The notification additionally contains every property’s market value and the degree of appraisal used to compute the tentative assessed value, alongside supportive clarifications of these terms. The scar filing period started Monday, May 25, 2020, and will go through Wednesday, September 4, 2020

Web the land records viewer permits admittance to practically all data kept up by the department of assessment including assessment roll data, region data, charge maps, property photos, past expenses, charge rates, exclusions with sums, and similar deals. It would be ideal if you note that as per the law, the documentation must be done on the county endorsed structure and arrangement.

Staying up with the latest our evaluations mirror the land market which shows that home estimations are commonly expanding, which is an extraordinary thing for Nassau County’s mortgage holders. Notwithstanding being posted on the web, a yearly notice of tentative assessment with these updated values were sent to each property holder. It furnishes each landowner with an updated value of their property.

Newsday

Nassau Reassessment more attractive and more exact, examination shows in line with Nassau County Executive Laura Curran, the assessment review commission has consented to give a beauty period to document a complaint until Thursday, April 30th, 2020. District Executive Laura Curran’s taxpayer protection plan taxpayer protection plan proclamations that show speculative assessed property charges for the 2020-2021 expense year are accessible online at mynassauproperty.com.

Additionally, an as of late delivered report by the New York city advisory commission on property tax reform suggests that yearly valuation changes for NYC private properties be staged in more than five years. Moreover, Nassau County accepts no liability related with the utilization or abuse of such data.

**Please note, the county assessor and county clerk databases’ are designed distinctively and may have better place holders for area, square, and parts.

Click here to also check out icanhas.cheezburger.com, Northshoreconnect.org/signup, Pearson.com/myprogramminglab, Meetscoresonline.com

Curve’s final determinations detail that the filing period to challenge arc’s conclusions runs from April 1st through April 30th however, because of the current public security and wellbeing concerns, Governor Cuomo and the NYS unified court system have taken measures to broaden this filing period. The recording of the annual survey of income and expense (ASIE) with the department of assessment is obligatory as required under section 6-30 of the Nassau County administrative code. The public information contained in this is outfitted as a public service by Nassau County for use as an examination instrument.

For your benefit, duplicates of duty guides can be bought at the tax map division window from 9 a.m. To 4:30 p.m. Terms and conditions of use: the public information contained thus is outfitted as a public service by Nassau County. All ASIE 2013 and ASIE 2014 filings should now be submitted through our online application discovered here ASIE 2013/2014. Proprietors of proprietors involved property, property under development, and property that was sold or bought during the schedule year 2016 should likewise document an ASIE statement.

Conclusion

Timetable a physical inspection of your property if you might want to plan a physical inspection of your property, if it’s not too much trouble send an email to [email protected] or a letter to 240 old country road, fourth floor, Mineola, Ny 11501.

Evaluations will be probably distributed in January, become last on the main business day in April of the next year, and are utilized for school charge bills in October of that year and for general tax bills in January of the following year. This contains a lot of property guides of each package inside the County of Nassau. If you have queries about countywide property reassessment, property maps, property records, property tax exemption, property valuation updates, real estate market, Property location details, real estate business, private property or property taxes, leave us a comment in the box below.