What is a Chase Credit Score? First of all, Credit cards are the initial step in establishing a credit history for some people. Loans, credit limits, payment plans, and credit requests are next on the list. Did you know, though, that Chase credit card can check their credit score whenever and as frequently as they want?

Yes, Chase already made that possible. Even if you are not a Chase account holder, you may do so. All you need is to register for the Chase Credit Journey website and you are all set. You may use the site to check your credit score. And you know what, there’s more to it than meets the eye. If you want financial institutions to trust you and provide you access to their services, your credit score is crucial. If you have a negative credit score, your Chase credit card application will be delayed significantly. Let me tell you all about it here.

What is a Credit Score?

A credit score is a number that evaluates a person’s creditworthiness and is based on his or her credit history. Creditors use credit scores to evaluate an individual’s ability to repay his or her debts. A person’s credit score ranges from 300 to 850. The higher the score, the more financially trustworthy a person is considered to be.

How to Check your Credit Score (Chase)?

There are two ways where a person can check his or her Chase credit score. The one is for the already members of Chase via their online page. And the other one is for Chase Business Customers and non-members. Although they are different in terms of status, they will still be using the same Chase Credit Journey platform. Here is how it goes.

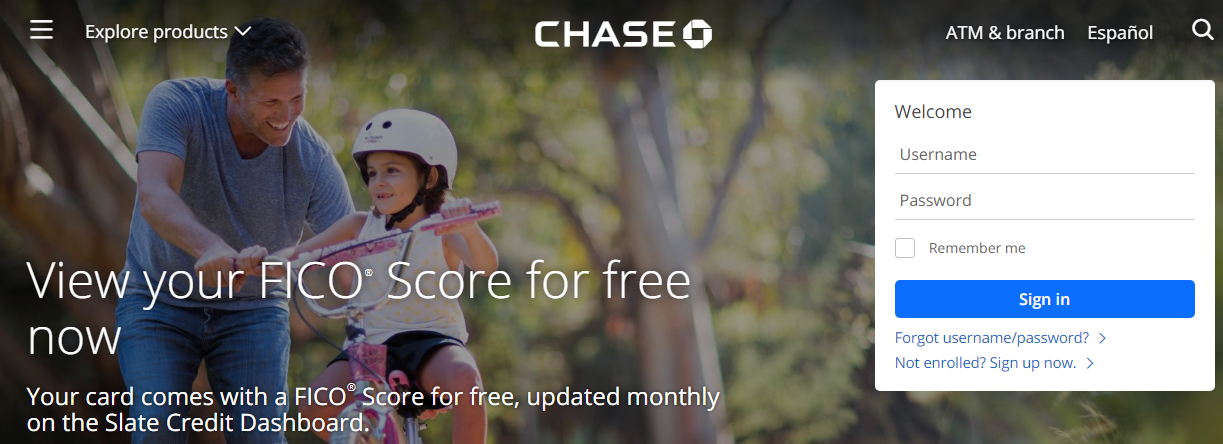

- First, open your web browser. You can use your smartphone, laptop, or PC with this. And any browser will do.

- Type in your browser’s address bar this: https://creditcards.chase.com/free-credit-score

- On the Chase page that will appear, log in if you already are registered with the Chase Credit Journey. Or you may sign up one time to get access. The same goes for both Chase accountholders and non-members.

- Once you are logged in to Chase online, just scroll down until you see Your credit score on the left side of the page. Click on the Free score, updated weekly link to access Chase Credit Journey.

- Sign in to the Chase Credit Journey page.

- Fill up the required information plus the click the one-time consent button.

- On the next page, your credit score will be prominently displayed on your Chase Credit Journey home page. If you like to see the history of your credit score, click on Over Time to see a graph of the activities in the previous six months.

- You may now view your credit score history as well as other features such as email notification about your recent credit-related activities.

Knowing your credit score is important, particularly when you have plans of having major purchases or loans. This ensures your purchase or loan will be approved.

Access credit score for free

The Chase allows you to check your VantageScore 3.0 from TransUnion for free. Experian, TransUnion, and Equifax came up with the algorithm to produce VantageScore, competing against the better-known FICO scores. VantageScore initially used a different scale, but most recent revisions now have a 300 to 850 scale, which is similar to FICO’s.

While banks and companies use FICO score, one of the major credit scores, to check your credit, VantageScore is another credit score, which does the same thing. With slight variations, they both check how creditworthy you are.

Chase gives you access to your credit score for free as well as the 12-month history of your score. Thus, you can see changes in your score over time, which is super helpful if you’re working to improve it.

Credit Score (Chase) Alerts

Aside from showing your current credit score, it also shows and even notifies you of any vital changes regarding it. This way, you will know when your credit score is going up or going down.

That means if you are updated with your score, you can easily do something about it. Like pay off some debts or make some necessary arrangements to fix your score.

Another important feature is the ability of their service to send you alerts if there are some activities that seem a fraud. This way, you are somewhat on guard with your account from malicious attempts and entities. For more information about this feature, you may contact Chase Customer Service hotline.

Factors that affect credit score

In case you are wondering how credit scoring gets evaluated, we can tell you the basic things on how it works. It’s simple yet in real life, sometimes you just couldn’t keep at it.

You can see these six factors listed on your credit score page. However, if you want to see them in more detail, you may click on Explore factor details and you will be able to see how each factor affects your credit score.

Six main factors

The Chase Credit score is based on six main criteria. These factors are combined to determine your credit score, which will range between 300 and 850. Here are the things that affect your Chase credit score.

- Late payments: Late payments made more than 30 days from the due date are usually reported and will be visible on your credit report for 7-10 years.

- Age of oldest account: It is good to show that you have been financially responsible for a long time, so your oldest account’s age is important. Closing your oldest account will negatively impact your credit score.

- Credit usage: Your credit utilization ratio is the percent of your current credit limit you are using. You want to keep a low number here, which shows creditors that you don’t maximize out your available credit. Generally, 30% is considered good.

- Hard inquiries: Often called “hard pulls,” your requests to see your credit history in the past two years also affect your credit score, particularly when you open a new credit card or apply for a loan. Six or more inquiries are considered poor, but it doesn’t have a huge impact on your score.

- Total balance: This is the sum of the current amount you owe in all lines of credit. It is good to keep this low. However, this also includes things like mortgages, so it can be high without any impact on your credit score.

- Available credit: This is the current unused credit you have over all of your accounts. The number is not as important as the utilization ratio. As long as you aren’t maxing all your credit limit, it’s OK for this number to be big.

What positively affects your credit score?

- Using less than 30% of your credit limit. If you spend less using your credit card that means you have a well-balanced lifestyle. Your income can well support your expenditures and therefore, you can actually pay your charges.

- On-time bill payments.

- A long and diversified credit history.

What negatively affects your credit score?

- Too many requests for new credits

- Late bill payments. No matter what your reasons are, once you are late paying your bills, it stays and gets on your credit record. So as much as you can, try to make amends with your due dates. Or else, you will accumulate bad records on your credit history.

- Spending more than 80% of your credit limit.

Important Things To Know

Chase Credit Journey is a free tool to let you access your credit score. The following are some important facts about it.

First, Chase Journey provides your VantageScore, not your FICO score. When getting a mortgage or applying for credit, your lender may see a different score than what you are seeing. This is normal since VantageScore uses a slightly different calculation. However, a “good” credit score is typically good across all platforms while “bad” is typically bad.

Second, you cannot see your full credit report on Chase Journey, but you can access it for free at AnnualCreditReport.com. You can check your credit report for free once per year from each credit reporting agency. This is a great way to reflect on every item impacting your credit score.

What to do if I suspect something wrong with my credit score?

It is possible to see a different result from your Chase Credit Journey information and other platforms. Here are a few things to consider doing:

- Your recent activity may not yet be included in your VantageScore® credit score. If opening an account or paying a balance, it takes time for TransUnion® to get that information and include it in your score calculation.

- Chase Credit Journey uses the VantageScore® 3.0 credit score by TransUnion®, but other scoring models and providers are available in the market.

- Since the information and score calculations can vary between credit bureaus, you could have different scores among these credit agencies like TransUnion®, Experian, and Equifax.

- If you think your information still does not look right, you can visit www.annualcreditreport.com to request for a copy of your detailed credit report. You can get a free credit report from each of the three major credit reporting agencies (TransUnion®, Experian®, and Equifax®) every year.

FAQ

A credit score is a number that evaluates a person’s creditworthiness and is based on his or her credit history. Creditors use credit scores to evaluate an individual’s ability to repay his or her debts. A person’s credit score ranges from 300 to 850. The higher the score, the more financially trustworthy a person is considered to be.

The Chase allows you to check your VantageScore 3.0 from TransUnion for free. VantageScore initially used a different scale, but most recent revisions now have a 300 to 850 scale, which is similar to FICO’s.

Go to the website https://creditcards.chase.com/free-credit-score and log in or register. When you are registered, fill up the required information. After clicking the one-time consent button, you are free to see your credit score.

Log into the Chase app and scroll down until you see Credit score.” By clicking on it, you will be shown your credit score.

Log in to your Chase online account, scroll down until you see “Your credit score” on the left side. Click on the “Free score, updated weekly” link to view your credit score.

The Chase’s credit score is updated weekly and it is free, although it only comes from one bureau.

Chase gives you access to your credit score for free as well as the 12-month history of your score. Thus, you can see changes in your score over time, which is super helpful if you’re working to improve it.

This tool also provides free credit alerts to ensure that you are aware of any changes to your credit standing. This is helpful if you are concerned about identity theft.

Derogatory records are reports made to credit bureaus, which negatively affect your credit score and can stay on your credit history for up to 10 years. These can result from a delinquent account, repossession, collection, bankruptcy, account charge-off, tax lien, or civil judgment.

Log in or sign up on their website, then will you will be able to check your credit score.

Important Reminders

Your credit score is important if you want financial companies to trust you and give you access to their services. Your Chase credit card application status will be affected greatly if you have a bad credit score.

Although there are some circumstances that cannot be helped when it comes to financial ins and outgoings. But always try to make an effort to pay on time and spend only the amount that you can afford. Otherwise, you will be paying an amount that is in way over your head. If you want to know more, you may just contact Chase Customer Service hotline.

Conclusion

Chase provides you with free access to your credit score as well as a 12-month history of your credit score. As a result, you can track your score over time, which is really useful if you’re trying to improve it.

So in today’s question, how do you find Chase Credit Journey compared to other credit score checking services? Is it accurate and reliable? Should you recommend it to other people like your friends and family? Are you a family person? Get your credit in shape before the family grows. Be credit ready with good credit score knowledge. Tell us your thoughts in the comment section below to help others learn about this Chase overall quality of service. Got questions about business credit score, access to credit, credit criteria, annual credit report, business credit check, Chase Credit Journey, Credit Health, healthy credit scores, personal credit history/ personal credit score? Let us know in the comment section below!